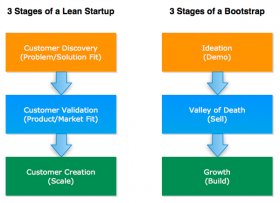

Without a similar thing, Bootstrapping and Lean Startups can be complementary. Both cover techniques for creating low-burn startups by detatching waste through the maximization of present resources first before expending effort on acquisition of brand new or external sources.

Without a similar thing, Bootstrapping and Lean Startups can be complementary. Both cover techniques for creating low-burn startups by detatching waste through the maximization of present resources first before expending effort on acquisition of brand new or external sources.

While bootstrapping provides a strategic roadmap for achieving sustainability through customer funding (i.e. recharging clients), lean startups offer a more tactical way of attaining those targets through validated learning from customers.

But before going any more, I’d love to dispel some common misconceptions about both approaches:

Myth: Lean Startups tend to be inexpensive startups

This characterization isn’t totally mistaken but it only catches a sliver of what being slim is focused on. Eric Ries co-opted the term “Lean” from “Lean Thinking” which arises from manufacturing.

Being lean just isn't about becoming low priced but becoming efficient with sources..

Money is one among those resources and there is an occasion to save spending (before product/market fit) and a time to pay (after product/market fit). Our scarcest resource, however is time.

A Lean business after that optimizes for researching what’s riskiest in the industry design per device time.

But even at the earlier in the day stages when we do enhance for time, money, and energy, folks usually associate Lean — especially the notion of the minimal viable item (MVP), as a cheap and fast launch 1.0.

An MVP is NOT about being inexpensive and fast but cheaper and quicker compared to the alternative.

Consider these MVP from Litmotors:

Consider these MVP from Litmotors:

The alternative had been raising huge amount of money in funding, finding lovers, and creating a road ready vehicle which under conservative estimates will have taken the business two years to pull off.

Rather, the founding group raised a tiny seed round and built the first MVP manually in a garage they rented. The MVP took all of them 12 days to perform (the robocop looking part of the photo above) which allowed all of them to safe enough down-payments from early adopters to raise a much bigger round and go after production prepared batches (the finished vehicle in the image above).

MVP Directive: Race to provide price.

Myth: Bootstrapped startups never raise money

Most bootstrapped startups begin with some type of preliminary self-funding (sweat equity, credit cards, savings, etc.) and work their particular method towards durability through consumer obtained financing. But given the kind and phase associated with the company, even bootstrapped organizations can and sometimes do elect to boost extra money if that’s what’s needed for growth.

Appropriate Action, Appropriate Time

I’ve bootstrapped all my businesses up to now and learnt a great deal about bootstrapping from Bijoy Goswami, founder of Bootstrap Austin. Bijoy does not limit the definition of bootstrapping into additionally held one about creating an organization without outside money but rather views bootstrapping as a philosophy summarized as “Right Action, Right Time”.

This mantra applies just as well to lean startups because does to bootstrapping:

At every phase of the startup, there are a couple of activities which can be “right” for the startup, for the reason that they optimize return timely, cash, and effort.

A lean/bootstrapped entrepreneur ignores all else.

While bootstrapping and lean startup strategies are not simply restricted to investment, capital is just one of the very first dilemmas business owners tackle. A lot of (especially first-time) business owners believe step one is writing a business program and having financed. But throughout the first stages of a startup, all you've got is a vision and a set of untested presumptions. Selling this to investors without any degree of validation is a kind of waste.

Waste is any man activity which absorbs resources but produces no value.

Waste is any man activity which absorbs resources but produces no value.

– James Womack

Getting funded is not validation

Seed phase people are only as bad at guessing just what items will become successful when you are. With no item validation to depend on, they hedge their particular bets against your team’s past history and storytelling ability. Therefore whilst getting financed during this period is a testament to your team development and pitching skills, it really isn’t item validation.

Everything gets ten times more expensive

Funding is not charity but an extremely high interest loan. You ought to return this investment at a 10x rate of return. Making sure that business mobile phone which used to set you back $100/mo before financing, today costs you $1, 000/mo post-funding!

Without validation you have got no control

Moreover, without validation you don’t have product/market credibility which usually comes at a cost – reflected in lower valuations and investor-favored term sheets.

People measure progress differently

While validated discovering could be the measure of progress in a lean startup, many people determine progress through growth. Reconciling the 2 throughout the initial phases of a startup (when the hockey stick is essentially flat) can be very difficult and distracting.

Getting funded constantly takes longer than you might think

Time is much more valuable than money. Could you instead invest six months pitching people to help you improve a story considering an untested item, or spending some time pitching customers in order to tell a legitimate tale centered on a tested product?

Early grip is a pre-requisite

Many of the top accelerators like to see you show some early traction even before thinking about the job. The common company that comes into Y Combinator, for-instance, yields $1, 000/mo in buyer revenue.

Grip speaks louder than words.

Excess amount can in fact hurt your

Money is an accelerant, perhaps not a silver bullet. It allows you to do more of what you’re at this time doing although not always better. Including, if you’re building an MVP, more money might lure that employ a lot more people and wait to create even more functions both that could in fact harm both you and seriously slow you down.

Limitations drive innovation but moreover force activity.

With less overall, you need to build less, have it down faster, and understand quicker.

Startups that succeed are those that manage to iterate enough times before running-out of resources. Time between these iterations is fundamental.

INTERESTING VIDEO